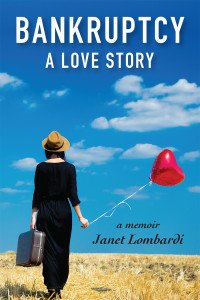

What’s bankruptcy got to do with love?

Find out in my memoir, Bankruptcy: A Love Story, published by Heliotrope Books.

Paperback and Kindle versions now available on Amazon!

Bankruptcy: A Love Story traces the compelling story of my family’s plunge into economic chaos after my attorney-husband is prosecuted for a white-collar crime and serves a year in prison.

As secrets are revealed, including a clandestine love affair, hidden drug addiction, and ruinous finances, I confront my own desires and demons, travel the route of survival, and navigate questions of love and redemption.

Bankruptcy: A Love Story roller coasters through sexual desire, addiction, financial collapse, and squandered love. Ultimately, the road back is lined with painful choices, desperate moves, and the knowledge that letting go provides the only real answer.